IABM’s CTO chats with Matt to talk about how AI being harnessed today to help media & entertainment companies to make them to be more nimble and productive today.

IABM’s CTO chats with Matt to talk about how AI being harnessed today to help media & entertainment companies to make them to be more nimble and productive today.

IABM’s CTO, Stan Moote talks with Qibb’s CEO, Jonas Michaelis, about how AI can improve content production and distribution without additional headcount.

Fabio Gattari and Alex Gattari from Etere both give their personal opinions where the broadcast industry is heading

Table of Contents

MediaTech Radar is a monthly newsletter authored by IABM’s Business Intelligence Unit. It focuses on a spotlight topic in MediaTech and reflects on a series of past, present and future business developments in the industry. In this edition, our spotlight topic is the upcoming IBC 2025, where we would like to share some insights on how IABM’s business intelligence can help our members and Global Engaged Partners prepare for the show and enhance strategic planning.

MediaTech Spotlight: Leveraging IABM’s business intelligence for strategic planning

A spotlight topic in MediaTech.

Trade shows aren’t just about visibility — they’re milestones in your annual strategy. With IBC 2025 approaching, effective preparation goes beyond booking a booth – it’s about equipping your team with essential industry insights. This edition of our monthly newsletter explores how to leverage the business intelligence resources available on IABM’s MediaTech Vantage™ platform to enhance both your show preparation and strategic planning.

IABM’s MediaTech Vantage™ platform is more than just a publishing hub – it is an interactive, collaborative workspace. Colleagues within the same company can share custom reports, pinned search results, and notes, ensuring teams stay aligned and have the essential data at their fingertips when preparing for meetings at IBC. Users can also access the quantitative data behind our charts by downloading it in Excel format – making it easy to integrate insights directly into presentations and strategic planning. If you are new to the platform, we recommend watching this short video, which provides a quick overview of its key features.

IABM will open IBC 2025 with the IABM Industry Impact Briefing: Leading Successful Transformations in Media Business, where our Head of Knowledge and Insight, Chris Evans, will debut highlights from our forthcoming State of MediaTech report. To get the most out of the upcoming IABM opening session on 12 September, we recommend revisiting insights from the first edition of the 2025 State of MediaTech report, prepared in the lead-up to NAB Show 2025. At the beginning of the year, IABM data showed that industry leaders expected more conservative investment in the year ahead, with AI & ML emerging as the most important and the fastest-growing technology trend in organizations’ roadmaps year on year. Security followed as the second fastest-growing trend in the same time period. Between June and August, we conducted the next wave of our tracking survey to capture how expectations have shifted throughout the year – insights that will be unveiled in the upcoming session at IBC..

Also available to access on MediaTech Vantage™, our Megatrends research series examines themes that are fundamentally reshaping the media technology landscape. In the Business Transformation report, published in March 2025, we explored the key drivers of ongoing industry transformation and outlined strategies to address the challenges they bring. The report features case studies from both end users and technology vendors, with insights drawn from in-depth interviews with industry experts and a survey of more than 50 senior leaders from media and technology businesses.

IABM data confirms that security remains a critical focus for media technology in 2025 – a topic frequently raised in conversations with industry experts. In response to this growing interest, IABM has published the second report in the 2025 Megatrends research series, Security in MediaTech Ecosystems. This report explores new cyber threats emerging from the broadcast and industry’s shift to software-defined workflows, as well as strategies to counter piracy that now increasingly targets streaming platforms.

The 2025 Megatrend report series is included in Platinum, Gold and Global Engaged Partners’ member benefits. These reports are also available to purchase independently.

If your business operates globally or is planning to enter new markets, you will find valuable insights in our GeoTracker™ report, published in June 2025. This report is especially useful for shaping regional sales strategies, with analysis tailored to five macro-regions. Platinum members have full access included in their benefits package, while other members and non-members can contact us for a quote to purchase either the complete report or individual regional chapters.

For more information about our research offering or to schedule a platform demo, please contact IABM’s Business Intelligence Unit at insight@theiabm.org.

MediaTech Watchlist: Canal+, Sony, OBS, ESPN, Paramount, Google…

A watchlist of selected past, present and future business developments in MediaTech.

Thank you for reading this newsletter. If there are topics you would like us to cover or if you have information/ideas that you would like to share, please get in touch with us.

The IABM Business Intelligence Unit

IABM’s CTO, Stan Moote chats with ThinkAnalytics’ Founder & CTO Peter Docherty about the benefits to operators and streamers having a single AI platform for content discovery, recommendations, advertising and more.

July 2025

MediaTech Radar is a monthly newsletter authored by IABM’s Business Intelligence Unit. It focuses on a spotlight topic in MediaTech and reflects on a series of past, present and future business developments in the industry. In this edition, our spotlight topic is the convergence between broadcast, Pro AV and IT technologies. IABM and AVIXA recently launched a collaborative survey titled “Technology Democratization and Broadcast AV Convergence”, in the lead up to InfoComm. The term Broadcast AV has emerged to refer to the use of broadcast quality equipment and workflows by end-users in market verticals outside of media and entertainment as an extension of their AV capabilities. This month we will explore trends and insights gained from both the collaborative survey and discussions held at InfoComm. These recent insights build on themes explored in IABM’s “Democratization of MediaTech” report which is available to IABM members on our business intelligence platform, MediaTech Vantage™.

A spotlight topic in MediaTech.

The convergence of broadcast, Pro AV, and IT technologies is a trend that stems from common technology innovation, the transition from hardware to software, the migration of point-to-point signal distribution to IP networking, and the deployment of applications and resources in the cloud. The synergies between solutions developed for end-users in each respective market have been compounded by the increasing usage of video not only for entertainment but also as a fundamental communication technology across every market vertical.

While Pro AV markets like corporate, government, education, house of worship, healthcare, and retail are not new to investing in broadcast products, the scale of opportunity has grown as a greater number of end-users in these verticals are gaining confidence with the benefits of using professional video equipment and incorporating broadcast tools into their organizations.

IABM and AVIXA have observed how this market trend is creating opportunities for vendors serving both the broadcast and Pro AV markets respectively, and partnered to uncover more insights into how members of both organizations’ communities perceive this convergence trend by distributing a collaborative survey.

When asked how the convergence of Pro AV and broadcast is impacting their business, respondents to the collaborative survey revealed further insights:

“This convergence represents the flattening of different markets and customer expectations about the capabilities and usability of technology solutions in the marketplace. The result of this is a renewed focus on the outcomes and cost effectiveness of solutions over the technical specificity of the solution to the business challenge.”

Another respondent highlighted “the increasing integration and shared technologies between the two previously distinct industries. This convergence is driven by factors like the rise of live streaming, demand for higher quality video and audio, and the adoption of IP-based technologies. It essentially blurs the lines between traditional broadcast workflows and Pro AV applications, impacting how content is created, managed, and delivered.”

These statements encapsulate common sentiments that are regularly heard in relation to broadcast and Pro AV convergence. For IABM and AVIXA to quantify the aspects of convergence that are having the greatest impact on organizations’ business, participants were asked to rate the extent to which they agreed with a series of statements about the effects of convergence from strongly disagree to strongly agree. The three that ranked the highest in terms of the proportion of respondents from IABM’s sample that answered “strongly agree” were:

This evidences that industry convergence is taking place and will continue as vendors invest in new technology outside of their core field, and are willing to build new partnerships to accelerate momentum into parallel markets. However, this momentum is motivated overall by the goal of building new revenue streams and expected therefore to deliver a return.

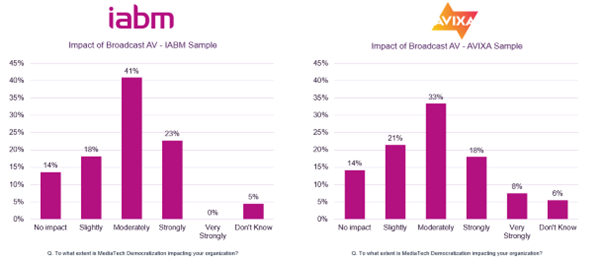

Survey participants were asked succinctly, “to what extent is Broadcast AV impacting your organization”. Below a comparison can be made between responses given by IABM’s community and AVIXA’s. While an almost identical proportion of respondents in each sample respectively (80-81%) recognised an impact on their organization, there was variance in the extent to which this was felt.

Among the respondents that indicated that the Broadcast AV trend is already impacting their organization, a follow up question was asked to detail the effect on their business:

“We see the expanded Broadcast AV market in the expanded breadth of customers coming to us, as well as the use case landscape increasing proportionally. This has resulted in new product development and new go-to-market strategies.”

In addition to acknowledging the expanded addressable market created for broadcast products, the advancement of IP signal distribution was highlighted by another respondent as a major influence: “Increasingly relying on IP-based technologies like NDI, SRT, and Dante AV for video transmission, production, and switching. The shift from traditional analog signals to IP-based networks enables greater flexibility, scalability, and interoperability between different equipment and systems.”

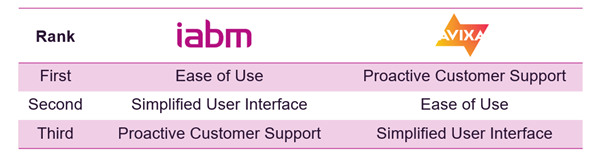

For technology vendors to tap into the opportunity presented by Broadcast AV, vendors need to review their product portfolios and identify if they need to develop new products, reposition existing technologies, or tailor their brand positioning and go to market strategy for increased relevance to customers in parallel markets. When presented with a series of considerations for products to be successful in Broadcast AV, the same group of three answers ranked as the top three from both IABM and AVIXA’s survey samples, with a slight difference in order:

When reviewing the responses received by IABM and AVIXA independently, a subtle difference can still be inferred. Broadcast end-users pride themselves on their ability to manage complexity, however that level of ability is not guaranteed in parallel markets, and therefore, ease of use must be the primary consideration for vendors in designing and marketing their products. Meanwhile for Pro AV users that do not necessarily have dedicated video training and Broadcast AV as a competency, among their other competing responsibilities, access to proactive customer support is vital for when troubleshooting exceeds their own capabilities.

To explore this topic further, watch IABM’s Head of Knowledge, Chris Evans, and AVIXA’s VP Market Insights, Sean Wargo, exchange perspectives on how Broadcast AV convergence is resonating with each organizations’ members respectively.

A watchlist of selected past, present and future business developments in MediaTech.

Thank you for reading this newsletter. If there are topics you would like us to cover or if you have information/ideas that you would like to share, please get in touch with us.

The IABM Business Intelligence Unit

This year’s AGM brings together global thought leaders, industry changemakers, and the IABM community for an energizing session filled with insight, direction, and shared ambition. Attendees will hear directly from IABM’s CEO and Board, gain the inside track on what’s ahead for major events like IBC, NAB, and AVIXA, and take part in celebrating the industry’s progress while helping shape what comes next.

MediaTech Radar is a monthly newsletter authored by IABM’s Business Intelligence Unit. It focuses on a spotlight topic in MediaTech and reflects on a series of past, present and future business developments in the industry. In this edition, our spotlight topic consists of experiences and insights gathered by the IABM team at major international trade events – CABSAT, Broadcast Asia and InfoComm 2025 – which took place in May and June. At these events, IABM not only supported members in the IABM Member Lounge, but also curated stage programming ranging from business intelligence briefings and panel discussions to editorial IABM TV interviews.

At CABSAT and InfoComm, IABM collaborated with AVIXA by co-hosting panel discussions to inform members about recent trends in Pro AV verticals and other adjacent markets. At Broadcast Asia, IABM hosted a pre-show welcome and networking event, sponsored by the UHD World Association, which was attended by international and regional members to connect and share expertise. The convergence of broadcast, AV and IT technologies was evident at InfoComm 2025 – organized in Orlando in early June – which gathered approximately 30,000 attendees, as IABM hosted a series of presentations and panels on the event’s new Spotlight Stage.

MediaTech Spotlight: CABSAT, Broadcast Asia and InfoComm 2025

A spotlight topic in MediaTech.

CABSAT:

According to CABSAT, the 2025 editions of CABSAT, Integrate Middle East and the debut edition of SATExpo Middle East – all organized simultaneously in the same hall in the Dubai World Trade Centre on May 13th-15th – were attended by over 32,000 professionals from over 120 countries. At CABSAT, IABM and AVIXA co-hosted an UpStream Dubai, providing a regional outlook of the Middle Eastern market as well as an update about the latest trends in both the global media & entertainment and the broadcast AV markets. IABM’s Industry Impact briefing highlighted that the ongoing streaming boom, especially in the Gulf countries and media businesses’ increased focus on content production for digital platforms and social media, are cannibalizing tech investment that has formerly been allocated to physical infrastructure, making the overall investment landscape relatively flat in the region. While the adoption of IP and cloud is gradually taking off, some major sales channels challenges are slowing down adoption. Challenges include government-funded media businesses’ difficulties with migrating to OpEx payment models for new investments. However, the Saudi Vision 2030 initiative is catalyzing several new greenfield projects, including installs that integrate with cloud architecture in Saudi Arabia, where both AWS and Microsoft Azure are going to launch new data centers in 2025. Our conversations with members in the show confirmed this – several vendors said that they are currently screening opportunities as well as looking for local partners in the Saudi Arabian market. Members’ optimism is stemming from the fact that the Gulf countries are investing heavily in Tier 1 and Tier 2 sports, driving demand for new technologies such as IP and cloud. For more insights, please view IABM’s presentation and watch catch-up videos from the event here.

BroadcastAsia:

In late May, IABM attended BroadcastAsia in Singapore, supporting members in the IABM Member Lounge, featuring members in IABM TV interviews and providing a half-day stage programme for the BroadcastAsia Conference, in collaboration with Asia Tech x Singapore. The event included two presentations and three technology panels with themes ranging from technology standards to piracy and immersive formats. IABM’s observations and conversations with a wide range of regional industry stakeholders confirm that the business environment outlook in the APAC region remains stable, but increasing geopolitical tensions and trade restrictions – especially those related to the semiconductor industry – are translating into economic uncertainty and growing supply chain risks. Also, the slowdown of the Chinese economy is having a negative spillover effect on other countries in the region. IABM’s Industry Impact briefing noted that the APAC region accounts for about 75% of global semiconductor manufacturing capacity, making the region a key player in the global AI chip race and AI-related exports. The region’s significant consumer market is embracing mobile streaming with social media platforms dominating audiences’ media consumption, especially in China. These platforms are also investing in Tier 1-2 sports, driving media businesses’ move to remote production and hybrid cloud production as the connectivity gets better. However, the region remains vulnerable to piracy as many media companies still rely on satellite uplinks making the “first mile the weakest mile”. Overall, conversations with members and regional stakeholders highlighted that there is still growth in the region, but that each local market has its unique characteristics that affect customers’ investment priorities (e.g. weak currency in Japan or cheap mobile data in India). More conversations with members at BCA can be found here.

InfoComm 2025:

At InfoComm 2025, IABM and AVIXA continued their collaboration launched in Q1 2025 at ISE. In addition to supporting members in the IABM Member Lounge, IABM hosted three insight sessions at the event’s new Spotlight Stage exploring Technology Democratization and Industry Convergence, Automated Production and Skills Augmentation, as well as Selling Professional Video Products as Solutions. Conversations at InfoComm reflected the diverse range of perspectives in this expanded addressable market. IABM members expressed positivity due to the opportunity for new lead generation that industry convergence has opened up, however longstanding Pro AV brands noted many of the same issues IABM members had faced at NAB Show Las Vegas in terms of international customer attendance and the challenges of the current geopolitical climate. From a technology standpoint control and orchestration was front of mind as vendors seek to provide simplified management and interaction with increasingly sophisticated inventories of devices that customers are building out across multiple sites and campuses thanks to the benefits of networked infrastructure. For vendors strategic partnerships, interoperability, and certification are evidently vital to ensure their products are specified by systems integrators or included in product bundles used by dealers and resellers to market to the many different user profiles and use cases. Over the past six months, IABM’s Business Intelligence Unit has extended its research offering to increasingly capture trends related to convergence and opportunities in new markets. IABM’s Democratization of MediaTech report was published in December 2024 and a dedicated chapter on the migration to IP will feature in the forthcoming TechTracker™ report due for publication in September 2025.

MediaTech Watchlist: Disney, CPB, Sinclair, Creator Television, and others…

A watchlist of selected past, present and future business developments in MediaTech.

Thank you for reading this newsletter. If there are topics you would like us to cover or if you have information/ideas that you would like to share, please get in touch with us.

The IABM Business Intelligence Unit

Succeeding in new verticals

IABM CEO, Saleha Williams, talks to Bob Boster, President of Clear-Com, about his company’s activities in markets outside of Broadcast, where Clear-Com has it roots. Bob describes the crossover point as ‘Broadcastish’, which he defines as being able to meet the increasing demands for quality as AV ramps up its importance in many different types of organizations. Bob also gives tips on how to succeed in selling into the growing AV space.