May 2023

MediaTech Radar is a monthly newsletter put together by IABM’s Head of Knowledge Lorenzo Zanni. It focuses on a spotlight topic in MediaTech and reflects on a series of past, present, and future business developments in the industry. In this edition, our spotlight topic is Disruption.

MediaTech Spotlight: Disruption

A spotlight topic in MediaTech.

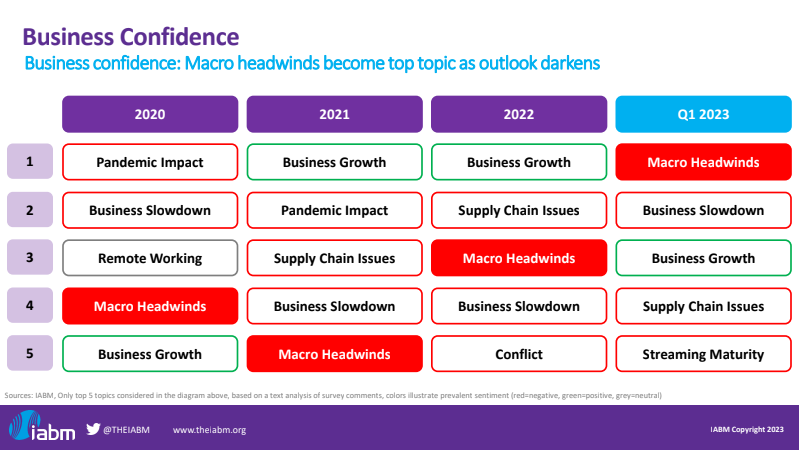

- IABM has recently published the results of a worldwide poll among broadcast and media professionals, conducted in March 2023, on what challenges their businesses are currently facing – ongoing supply chain disruption and other threats such as geopolitical risk and talent scarcity. Following is a summary of the Disruption Poll report’s findings:

- Sourcing hardware components: In 2022, 63% of respondents reported severe, and 34% moderate, issues sourcing components, with no one reporting zero issues. In 2023, the situation has improved markedly, with 24% severe, 38% moderate, 29% mild and (for the first time) 9% having no issues. Stockpiling has been the main strategy used to counteract supply chain issues.

- Geopolitical risk: Only 23% of businesses experiencing no issues or mild supply chain issues have strategies to mitigate geopolitical risk, compared to 57% among companies that experienced moderate to severe issues. Diversification is the most popular strategy to mitigate this risk, with 77% of respondents saying they were diversifying suppliers and increasing their presence in politically ‘safer’ countries.

- Talent shortage: Digital transformation has led to increased competition for talent between the broadcast and media industry and other sectors, including big tech companies, resulting in salary inflation. In March 2023, 87% of industry players said it was difficult or very difficult to recruit for tech roles. While 24% reported no change, 71% of respondents said that it became more/much more difficult to recruit candidates for technical roles in the last two years, which is about 80% of all who experience difficulties with recruiting.

MediaTech Watchlist: AI, Cloud, Convergence and more…

A watchlist of selected past, present and future business developments in MediaTech.

- This interesting Financial Times article (requires subscription) thoroughly examines the race towards Artificial General Intelligence (AGI) from the perspective of an AI investor and industry insider. As reported in the article: “We have gone from one AGI start-up, DeepMind, receiving $23m in funding in 2012 to at least eight organizations raising $20bn of investment cumulatively in 2023.” While many argue that AGI is still a long way off, the unprecedented speed of development of Generative AI technology in the last few months has cast doubts on any defined timeline for this. The article argues that the race for AGI should slow down to avoid unintended consequences, and that the industry should invest more in AI alignment – an area of AI research ensuring that the goals of machines “align” with human values. Having read this article after re-watching The Matrix on my way to NAB Show, I marveled at the movie’s potentially prescient story.

- Recent research conducted by Akamai on Cloud is consistent with the findings of our latest State of MediaTech report. While the research argues that Cloud is a strategic priority for 2023, it also reports that “organizations are walking the fine line between investing in cloud as well as being frugal in light of the macroeconomic headwinds.”

- My conversations at NAB Show highlighted that MediaTech Convergence is here to stay. Many MediaTech suppliers are seeing their shares of revenues derived from non-media markets such as Corporate rising, which is consistent with the findings of our latest State of MediaTech report.

- Media industry content spending will be flat in 2023, after growing 14% in 2022, according to MoffettNathanson. This is consistent with other forecasts reported in my previous newsletters.

- This IBC 365 article examines the impact of Arena TV’s collapse on broadcast technology financing and decision-making when it comes to Capex and Opex investment.

Thank you for reading this newsletter. If there are topics you would like me to cover or have information/ideas you'd like to share, please get in touch with us.

Lorenzo Zanni

Head of Knowledge

IABM