July 2025

MediaTech Radar is a monthly newsletter authored by IABM’s Business Intelligence Unit. It focuses on a spotlight topic in MediaTech and reflects on a series of past, present and future business developments in the industry. In this edition, our spotlight topic is the convergence between broadcast, Pro AV and IT technologies. IABM and AVIXA recently launched a collaborative survey titled “Technology Democratization and Broadcast AV Convergence”, in the lead up to InfoComm. The term Broadcast AV has emerged to refer to the use of broadcast quality equipment and workflows by end-users in market verticals outside of media and entertainment as an extension of their AV capabilities. This month we will explore trends and insights gained from both the collaborative survey and discussions held at InfoComm. These recent insights build on themes explored in IABM’s “Democratization of MediaTech” report which is available to IABM members on our business intelligence platform, MediaTech Vantage™.

MediaTech Spotlight: Technology Democratization and Broadcast AV Convergence

A spotlight topic in MediaTech.

The convergence of broadcast, Pro AV, and IT technologies is a trend that stems from common technology innovation, the transition from hardware to software, the migration of point-to-point signal distribution to IP networking, and the deployment of applications and resources in the cloud. The synergies between solutions developed for end-users in each respective market have been compounded by the increasing usage of video not only for entertainment but also as a fundamental communication technology across every market vertical.

While Pro AV markets like corporate, government, education, house of worship, healthcare, and retail are not new to investing in broadcast products, the scale of opportunity has grown as a greater number of end-users in these verticals are gaining confidence with the benefits of using professional video equipment and incorporating broadcast tools into their organizations.

IABM and AVIXA have observed how this market trend is creating opportunities for vendors serving both the broadcast and Pro AV markets respectively, and partnered to uncover more insights into how members of both organizations’ communities perceive this convergence trend by distributing a collaborative survey.

When asked how the convergence of Pro AV and broadcast is impacting their business, respondents to the collaborative survey revealed further insights:

“This convergence represents the flattening of different markets and customer expectations about the capabilities and usability of technology solutions in the marketplace. The result of this is a renewed focus on the outcomes and cost effectiveness of solutions over the technical specificity of the solution to the business challenge.”

Another respondent highlighted “the increasing integration and shared technologies between the two previously distinct industries. This convergence is driven by factors like the rise of live streaming, demand for higher quality video and audio, and the adoption of IP-based technologies. It essentially blurs the lines between traditional broadcast workflows and Pro AV applications, impacting how content is created, managed, and delivered.”

These statements encapsulate common sentiments that are regularly heard in relation to broadcast and Pro AV convergence. For IABM and AVIXA to quantify the aspects of convergence that are having the greatest impact on organizations’ business, participants were asked to rate the extent to which they agreed with a series of statements about the effects of convergence from strongly disagree to strongly agree. The three that ranked the highest in terms of the proportion of respondents from IABM’s sample that answered “strongly agree” were:

- Broadcast AV will generate new revenue streams for my organization (48%).

- Broadcast AV will require my organization to seek more collaborations and partnerships with other vendors (38%)

- Broadcast AV will require my organization to research and adopt new technologies (36%)

This evidences that industry convergence is taking place and will continue as vendors invest in new technology outside of their core field, and are willing to build new partnerships to accelerate momentum into parallel markets. However, this momentum is motivated overall by the goal of building new revenue streams and expected therefore to deliver a return.

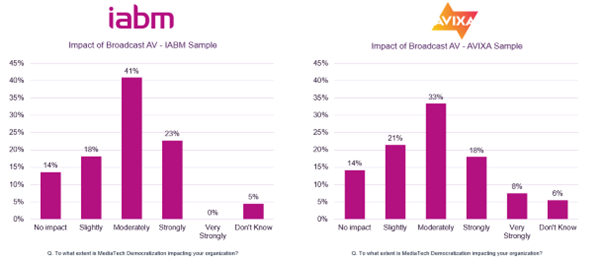

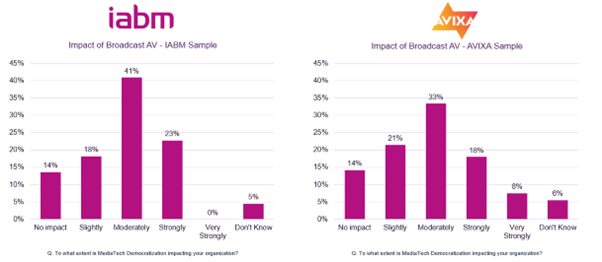

Survey participants were asked succinctly, “to what extent is Broadcast AV impacting your organization”. Below a comparison can be made between responses given by IABM’s community and AVIXA’s. While an almost identical proportion of respondents in each sample respectively (80-81%) recognised an impact on their organization, there was variance in the extent to which this was felt.

Among the respondents that indicated that the Broadcast AV trend is already impacting their organization, a follow up question was asked to detail the effect on their business:

“We see the expanded Broadcast AV market in the expanded breadth of customers coming to us, as well as the use case landscape increasing proportionally. This has resulted in new product development and new go-to-market strategies.”

In addition to acknowledging the expanded addressable market created for broadcast products, the advancement of IP signal distribution was highlighted by another respondent as a major influence: “Increasingly relying on IP-based technologies like NDI, SRT, and Dante AV for video transmission, production, and switching. The shift from traditional analog signals to IP-based networks enables greater flexibility, scalability, and interoperability between different equipment and systems.”

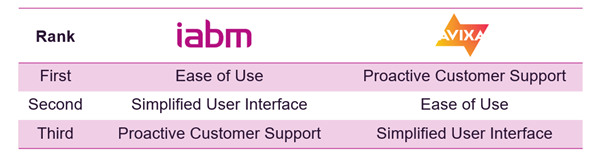

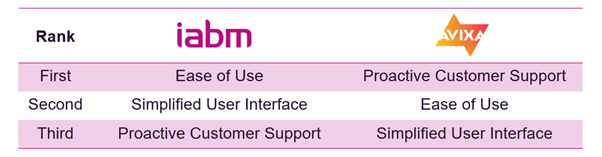

For technology vendors to tap into the opportunity presented by Broadcast AV, vendors need to review their product portfolios and identify if they need to develop new products, reposition existing technologies, or tailor their brand positioning and go to market strategy for increased relevance to customers in parallel markets. When presented with a series of considerations for products to be successful in Broadcast AV, the same group of three answers ranked as the top three from both IABM and AVIXA’s survey samples, with a slight difference in order:

When reviewing the responses received by IABM and AVIXA independently, a subtle difference can still be inferred. Broadcast end-users pride themselves on their ability to manage complexity, however that level of ability is not guaranteed in parallel markets, and therefore, ease of use must be the primary consideration for vendors in designing and marketing their products. Meanwhile for Pro AV users that do not necessarily have dedicated video training and Broadcast AV as a competency, among their other competing responsibilities, access to proactive customer support is vital for when troubleshooting exceeds their own capabilities.

To explore this topic further, watch IABM’s Head of Knowledge, Chris Evans, and AVIXA’s VP Market Insights, Sean Wargo, exchange perspectives on how Broadcast AV convergence is resonating with each organizations’ members respectively.

MediaTech Watchlist: France Télévision, Amazon Prime, RTL Group, ITVX

A watchlist of selected past, present and future business developments in MediaTech.

- France Télévision will distribute its streaming platform, France.tv, via Amazon Prime, including live channels and on-demand shows. The deal marks the first collaboration between the public service broadcaster and a US streamer. This news was swiftly followed by a reciprocal content sharing agreement between Disney+ and ITVX that will see each streaming service offering a dedicated showcase carousel of content to host select titles from one another’s catalogues, branded as “A taste of ITVX” and “A taste of Disney+” respectively.

- 26North Partners has acquired a majority stake in AVI-SPL, a leading integrator of AV, collaboration and experiential technologies with 4,400 employees across over 70 offices worldwide. The shares are purchased for an undisclosed sum from Marlin Equity Partners and other selling shareholders. Commenting on the investment, Mark Weinberg, Head of Private Equity at 26North said of AVI-SPL, “it operates in an expanding market, holds a leadership position, and serves a diversified, blue-chip customer base.”

- London Olympia will be the home to The Premier League’s new production department. As part of the move to bring broadcast operations in house, Premier League Studios will take over a 73,000 square foot site at One Olympia, with a 20 year commitment, and be responsible for all international media content production and distribution. A five year strategic partnership with Microsoft has also been announced, that will lend cloud and AI resources to The Premier League’s match analysis, digital platforms, infrastructure, and operations. Richard Masters, Chief Executive of the Premier League stated, “This partnership will help us engage with fans in new ways — from personalised content to real-time match insights.”

- RTL Group will purchase Sky Deutschland having confirmed a €150m upfront payment as part of a deal with additional variables driven by future value creation. The new combined media portfolio will claim 11.5m paying subscribers across RTL+, Sky and WOW. RTL Group which is known for its focus on news and entertainment will gain access to considerable sports rights through the acquisition as Sky Deutschland holds the media rights to Bundesliga, Premier League, DFB-Pokal and Formula 1. Thomas Rabe, CEO of RTL Group highlighted, “the synergies are estimated to be around €250 million per annum within three years after closing, creating significant shareholder value. Together, RTL and Sky will be in an even stronger position to invest in people, content and technology in Germany and in Europe to compete with the global tech and streaming players.”

- EVS opens a new regional hub at Mountain Media Center in Denver, Colorado. The hub is strategically located to offer service and support to a growing customer base operating across the North American time zones as well as housing a training facility as part of the company’s strategic expansion of operations in the region. Serge Van Herck, CEO of EVS, noted “establishing a hub in Denver reflects our commitment to investing in North American resources as a key pillar of our growth strategy.”

- Pinewood Studios have submitted a planning proposal for a new 55,030 square meter data centre with 60 acre nature reserve. The site at Pinewood South will be situated within the Slough Availability Zone and David Conway, Pinewood Group CEO emphasized that the proposal is “in alignment with the critical infrastructure needs identified by the government. The significant investment will bring jobs and additional benefits to the local community with the delivery of a nature reserve, community gardens and learning space.”

- Netflix will partner with NASA to carry streams from NASA+ including rocket launches, astronaut spacewalks, mission coverage, and live views of Earth from the International Space Station. NASA+ will remain freely available without advertisements through the NASA app and online, however the partnership with Netflix is intended to increase the organization’s engagement with global audiences, as Rebecca Simons, general manager of NASA+ outlines; “Together, we’re committed to a golden age of innovation and exploration – inspiring new generations – right from the comfort of their couch or in the palm of their hand from their phone.”

- Turkiye’s Transport and Infrastructure Minister, Abdulkadir Uraloğlu, plans to modernize the country’s broadcast infrastructure with plans unveiled for the construction of 30 new broadcast towers. Inspired by the success of the landmark, Çamlica Tower in Istanbul, the project will replace outdated antenna with a consolidated footprint of towers with “modern, architecturally integrated silhouettes”, that can provide services to both digital and analogue broadcasters with greater energy efficiency.

- BBC Sport posts record digital viewing figures for coverage of Wimbledon tennis championship with 69.3m online requests across BBC iPlayer, the BBC Sport website and app. Alex Kay-Jelski, Director of BBC Sport stated, “this year’s record-breaking digital figures for Wimbledon are testament to the huge appeal of the sport amongst audiences and the power of digital innovation to bring both new and existing fans closer to the action than ever before.”

Thank you for reading this newsletter. If there are topics you would like us to cover or if you have information/ideas that you would like to share, please get in touch with us.

The IABM Business Intelligence Unit

Among the respondents that indicated that the Broadcast AV trend is already impacting their organization, a follow up question was asked to detail the effect on their business:

“We see the expanded Broadcast AV market in the expanded breadth of customers coming to us, as well as the use case landscape increasing proportionally. This has resulted in new product development and new go-to-market strategies.”

In addition to acknowledging the expanded addressable market created for broadcast products, the advancement of IP signal distribution was highlighted by another respondent as a major influence: “Increasingly relying on IP-based technologies like NDI, SRT, and Dante AV for video transmission, production, and switching. The shift from traditional analog signals to IP-based networks enables greater flexibility, scalability, and interoperability between different equipment and systems.”

For technology vendors to tap into the opportunity presented by Broadcast AV, vendors need to review their product portfolios and identify if they need to develop new products, reposition existing technologies, or tailor their brand positioning and go to market strategy for increased relevance to customers in parallel markets. When presented with a series of considerations for products to be successful in Broadcast AV, the same group of three answers ranked as the top three from both IABM and AVIXA’s survey samples, with a slight difference in order:

Among the respondents that indicated that the Broadcast AV trend is already impacting their organization, a follow up question was asked to detail the effect on their business:

“We see the expanded Broadcast AV market in the expanded breadth of customers coming to us, as well as the use case landscape increasing proportionally. This has resulted in new product development and new go-to-market strategies.”

In addition to acknowledging the expanded addressable market created for broadcast products, the advancement of IP signal distribution was highlighted by another respondent as a major influence: “Increasingly relying on IP-based technologies like NDI, SRT, and Dante AV for video transmission, production, and switching. The shift from traditional analog signals to IP-based networks enables greater flexibility, scalability, and interoperability between different equipment and systems.”

For technology vendors to tap into the opportunity presented by Broadcast AV, vendors need to review their product portfolios and identify if they need to develop new products, reposition existing technologies, or tailor their brand positioning and go to market strategy for increased relevance to customers in parallel markets. When presented with a series of considerations for products to be successful in Broadcast AV, the same group of three answers ranked as the top three from both IABM and AVIXA’s survey samples, with a slight difference in order:

When reviewing the responses received by IABM and AVIXA independently, a subtle difference can still be inferred. Broadcast end-users pride themselves on their ability to manage complexity, however that level of ability is not guaranteed in parallel markets, and therefore, ease of use must be the primary consideration for vendors in designing and marketing their products. Meanwhile for Pro AV users that do not necessarily have dedicated video training and Broadcast AV as a competency, among their other competing responsibilities, access to proactive customer support is vital for when troubleshooting exceeds their own capabilities.

To explore this topic further, watch IABM’s Head of Knowledge, Chris Evans, and AVIXA’s VP Market Insights, Sean Wargo,

When reviewing the responses received by IABM and AVIXA independently, a subtle difference can still be inferred. Broadcast end-users pride themselves on their ability to manage complexity, however that level of ability is not guaranteed in parallel markets, and therefore, ease of use must be the primary consideration for vendors in designing and marketing their products. Meanwhile for Pro AV users that do not necessarily have dedicated video training and Broadcast AV as a competency, among their other competing responsibilities, access to proactive customer support is vital for when troubleshooting exceeds their own capabilities.

To explore this topic further, watch IABM’s Head of Knowledge, Chris Evans, and AVIXA’s VP Market Insights, Sean Wargo,