MediaTech Radar

September

MediaTech Radar is a bi-weekly newsletter put together by IABM’s Head of Knowledge Lorenzo Zanni. It focuses on a spotlight topic in MediaTech and reflects on a series of past, present, and future business developments in the industry. In this edition, our spotlight topic is the State of MediaTech.

MediaTech Spotlight: State of MediaTech

- On the first day of IBC 2022, IABM published its State of MediaTech report. Available to individuals registered on the IABM website, this report provides an in-depth strategic analysis of the MediaTech industry. If you have missed the report, use the QR code below to download it. In this newsletter, I have included (below) some of the main findings from this exclusive research study.

- The emergence of conflict in 2022 has triggered some trends reminiscent of the past. Aside from the geopolitical decoupling evocative of cold war times, pandemic-induced scarcity has been exacerbated, leading to the potential return of stagflation.

- While words such as decoupling, stagflation and bubbles remind us of the past, there are many reasons to believe the future will be different. COVID-19 has reshaped consumption patterns irreversibly, particularly for younger generations. Their inclination to digital interactions is not going away.

- General MediaTech investment has recovered from the trough in 2020, consistent with the outlook for media revenues improving as well as productions restarting. The same applies to supply-side revenues, with legacy sources such as hardware and permanent licenses bouncing back.

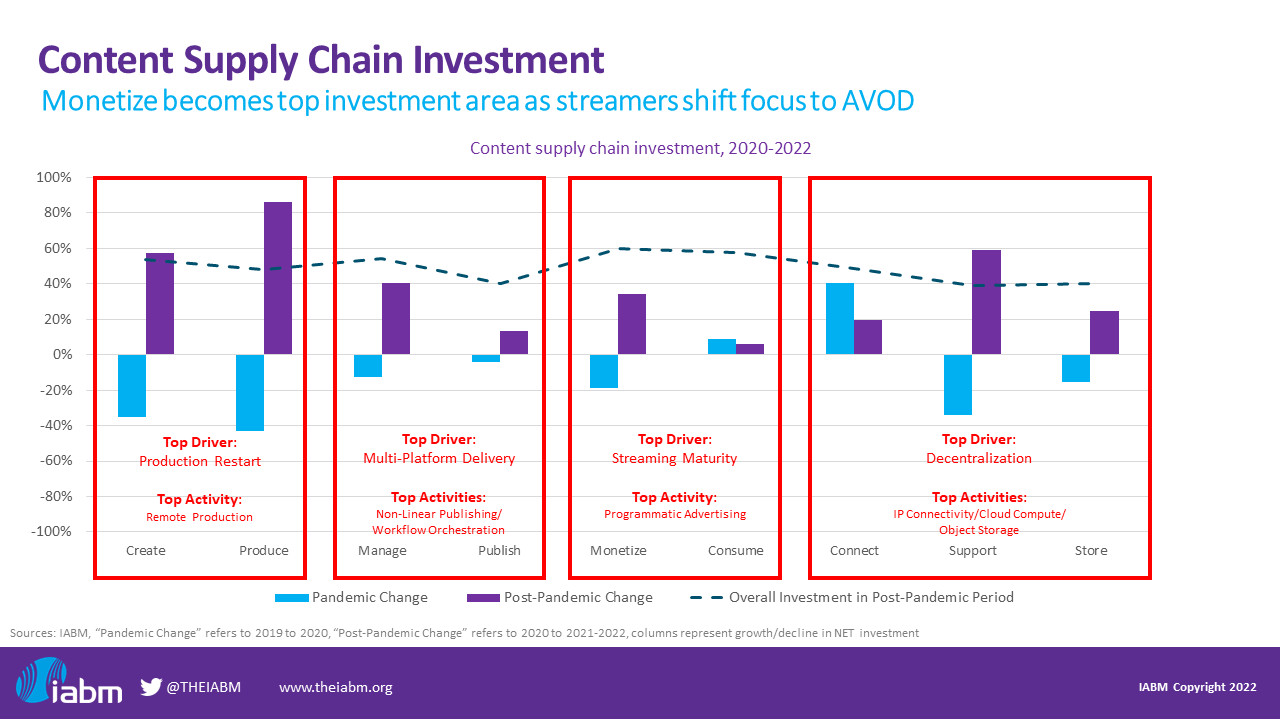

- The chart below is taken from the report and shows content supply chain investment during the pandemic and post-pandemic. The columns show change in investment while the dotted line shows the overall level of investment in the post-pandemic period.

- Content supply chain investment shows a changing picture reflecting major demand-side trends. While most segments have recovered from their declines in 2020, investment in Connect has slowed due to the normalization of connectivity spending after the exceptional growth of this supply chain area during the pandemic. Monetize has become the top investment area in the industry, surpassing Consume, which reflects the growth of AVOD models in the industry.

MediaTech Watchlist: PSBs, Alliance for Open Media and my IBC

A watchlist of selected past, present and future business developments in MediaTech.

- Pressure on European public broadcasting continues to grow. After the UK, France is planning to shake up how it funds public broadcasting by getting rid of the €138 fee paid by the 23m households equipped with televisions. This pressure goes directly against the increasing levels of funding needed by public broadcasters to compete with large streaming platforms, as reported in one of our previous newsletters.

- The European Union reportedly started an investigation into alleged anti-competitive behavior by the Alliance for Open Media. The investigation reportedly focuses on the licensing terms of the AV1 codec. This is not the first time that codec licensing models come under scrutiny, as HEVC was also heavily criticized in the past.

- As I said on my LinkedIn, I had a great time at IBC, and I think this edition was my personal favorite. My highlight was really people: meeting people I had met only on Zoom, meeting new people randomly, as well as friends I hadn’t seen in a while. I had the impression that most felt the same thing, which speaks loudly of how great the industry is.

- Moreover, I was fortunate enough to discuss the latest industry trends with an amazing group of speakers.

- On Friday 9 September, I moderated a panel that had the ambition of making sense of the change happening in MediaTech. The discussion with Michel Artieres from Ateme, Ben Kaplan from Backlight and Liz Davies from Diversified was very interesting and focused on supply chain disruption and supply-side business models in the industry.

- On Saturday 10 September, I moderated six of the eight sessions at the BaM Live™ Stage as part of our Convergence Day looking at topics at the intersection between different M&E sectors. We talked about Web3, Metaverse, Virtual Production, Global Streaming, Data & Churn, Creator Economy, and Super-Aggregation. All the sessions from Convergence Day and the other three days focused on Transformation, Resilience and Future Trends are available on the IABM website for catch-up viewing: head to the Knowledge Hub on our website and filter for videos. Happy viewing!

Thank you for reading this newsletter. If there are topics you would like me to cover or have information/ideas you'd like to share, please get in touch with us.

Lorenzo Zanni

Head of Knowledge

IABM