NStarX – The Live Sports Broadcasting Crisis: How AI Can Navigate the Perfect Storm

The Industry’s Growing Pains

Live sports broadcasting stands at a critical inflection point. What was once a straightforward linear television model has fractured into a complex ecosystem where fans need multiple streaming subscriptions exceeding $800 annually just to follow their favorite teams. The migration from appointment television to streaming platforms has created unprecedented technical and business challenges that threaten both viewer satisfaction and industry profitability.

The core problem isn’t just technological—it’s systemic. Rights fragmentation has scattered premium content across numerous platforms, from Amazon’s Thursday Night Football to Netflix’s Christmas games, creating a consumer experience that resembles digital whack-a-mole. Meanwhile, the technical infrastructure struggles under massive concurrent loads, with events like Peacock’s NFL Wild Card game consuming 30% of US internet traffic and demonstrating the internet-breaking potential of live sports streaming.

Real-World Impact: When Systems Crack Under Pressure

The industry’s growing pains manifest in measurable ways. Amazon’s Thursday Night Football, despite averaging 13.2 million viewers and demonstrating successful CTV scaling, represents just one piece of an increasingly fragmented puzzle. When Peacock’s exclusive NFL playoff game became the most-streamed US live event at 23 million average minute audiences, it revealed both the massive opportunity and the infrastructure stress points that plague the industry.

These technical challenges extend beyond mere buffering issues. NBCU’s Peacock experience highlighted the delicate balance between low-latency delivery and system stability. Achieving sub-10-second glass-to-glass latency while maintaining quality, server-side ad insertion (SSAI), digital rights management (DRM), and accurate measurement creates a technological house of cards that can collapse under peak concurrent loads.

The fragmentation extends to advertising and measurement, where marketers struggle with cross-publisher identity resolution and frequency management. Without unified measurement currencies, buyers juggle Nielsen ONE, iSpot, VideoAmp, and Comscore, creating operational inefficiencies that directly impact revenue optimization.

The Revenue Hemorrhage

These challenges create direct revenue impacts across multiple vectors. Fragmented rights and blackout complexities drive subscriber churn, with confused fans abandoning services when they can’t find their games. The technical instability during peak viewing moments—precisely when advertising rates are highest—results in failed ad deliveries and viewer abandonment.

Cross-publisher deduplication failures lead to frequency waste, where a small percentage of households consume disproportionate ad impressions without proper campaign controls. Meanwhile, the rising tide of connected TV (CTV) fraud, with DoubleVerify estimating 65% as bot-driven, directly erodes advertising effectiveness and buyer confidence.

The measurement limbo creates additional revenue leakage. Without real-time, unified metrics across linear and CTV platforms, media buyers cannot optimize campaigns effectively, leading to suboptimal spending allocation and reduced advertiser return on investment.

AI as the Great Orchestrator

Artificial intelligence emerges as the natural solution to orchestrate this complex ecosystem. AI’s pattern recognition capabilities can predict and prevent the concurrency issues that break streaming infrastructure. Machine learning algorithms can analyze historical viewing patterns, weather data, game importance metrics, and social media sentiment to forecast demand spikes with unprecedented accuracy.

For advertising, AI-powered identity resolution can create probabilistic matches across walled gardens, enabling true cross-publisher frequency management without compromising privacy. Real-time bidding optimization through AI can maximize ad revenue during those crucial peak moments when technical systems are most stressed.

AI-driven content delivery networks can dynamically route traffic, pre-position content, and adjust encoding parameters in real-time to maintain quality under varying network conditions. Predictive analytics can identify potential piracy sources and implement automated takedown procedures, protecting premium content rights.

Enterprise AI Strategy: Building the Foundation

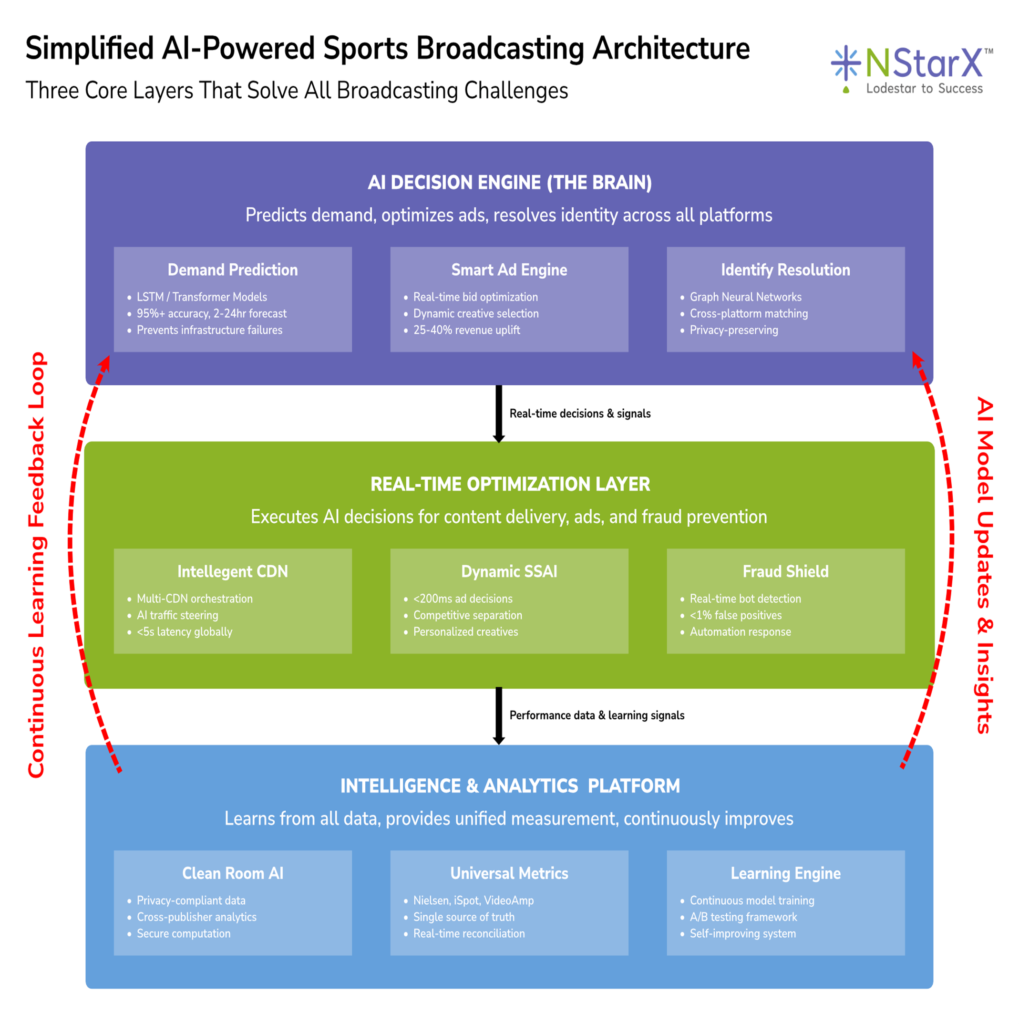

A simplified representation of what an AI-native system can help better solve the current challenges.

Figure 1: This is how the AI-powered broadcasting architecture would look like

Enterprises should approach AI adoption through a systematic lens, starting with data infrastructure consolidation. The fragmented nature of current systems means AI initiatives must begin with creating unified data lakes that aggregate viewership, engagement, technical performance, and revenue metrics across all platforms and touchpoints.

Clean room technologies, such as AWS Clean Rooms, provide the foundation for privacy-compliant data collaboration between publishers, advertisers, and measurement providers. This enables AI algorithms to optimize campaigns and content delivery without exposing sensitive competitive information.

Companies must invest in real-time AI capabilities rather than batch processing systems. Live sports demand immediate decision-making for ad insertion, content routing, and technical issue resolution. Edge computing integration allows AI models to operate closer to viewers, reducing latency while improving personalization capabilities.

Legacy System Integration Challenges

Broadcasting companies face unique AI adoption challenges due to decades-old infrastructure investments. Legacy systems often lack the APIs and data standardization necessary for AI integration. Broadcast control rooms operate on specialized hardware with vendor lock-in scenarios that resist modernization.

The cultural challenge runs equally deep. Broadcasting operations teams have developed complex manual procedures refined over decades. AI systems must demonstrate clear value without disrupting mission-critical live operations. The high-stakes nature of live sports broadcasts creates natural resistance to automation that could potentially fail during crucial moments.

Integration complexity multiplies when considering existing vendor relationships, union contracts, and regulatory compliance requirements that govern broadcasting operations.

Resolving Legacy Constraints

Successful AI integration requires a hybrid approach that respects existing investments while gradually introducing intelligent automation. API development should focus on creating data bridges between legacy systems and modern AI platforms without requiring complete infrastructure replacement.

Pilot programs should target non-critical operational areas first, building confidence and demonstrating ROI before expanding to core broadcasting functions. Shadow AI systems can operate alongside human operators, providing recommendations while humans retain final control during the learning phase.

Change management becomes crucial, with extensive training programs helping technical teams understand AI capabilities and limitations. Clear escalation procedures ensure human oversight remains available when AI systems encounter edge cases beyond their training parameters.

The AI-Powered Future Landscape

Full AI adoption transforms live sports broadcasting into a predictive, self-optimizing ecosystem. AI-powered demand forecasting enables infrastructure pre-scaling that prevents technical failures during unexpected viral moments. Dynamic content delivery adapts in real-time to network conditions, device capabilities, and viewer preferences.

Advertising becomes truly addressable at scale, with AI managing frequency, competitive separation, and creative optimization across all viewing platforms simultaneously. Revenue optimization occurs automatically, with AI adjusting ad rates, content recommendations, and subscription offers based on real-time engagement patterns.

Fraud detection operates proactively, identifying suspicious traffic patterns before they impact legitimate viewers or advertiser metrics. Rights management becomes automated, with AI monitoring global content distribution and automatically enforcing territorial restrictions.

Uncovering AI Blind Spots

Despite AI’s transformative potential, enterprises must acknowledge inherent limitations. AI models trained on historical data may fail to predict unprecedented events or rapid changes in viewer behavior. Algorithmic bias can create unfair advantages for certain demographics or content types.

The black-box nature of some AI systems creates accountability challenges when automated decisions impact revenue or viewer experience. Regulatory compliance becomes complex when AI systems make real-time decisions that affect content distribution or advertising delivery.

Continuous monitoring and human oversight remain essential, particularly for edge cases that fall outside AI training parameters. Regular algorithm audits help identify drift in model performance and potential bias introduction over time.

Conclusion: Navigating the Intelligent Future

The live sports broadcasting crisis demands sophisticated solutions that match the industry’s complexity. AI provides the orchestration capabilities needed to manage fragmented rights, technical scaling challenges, and revenue optimization simultaneously. However, successful implementation requires strategic planning, legacy system integration, and ongoing human oversight.

Companies that invest in AI infrastructure today will emerge as leaders in the post-fragmentation era, delivering superior viewer experiences while maximizing revenue opportunities. Those that delay AI adoption risk becoming casualties of an increasingly complex and competitive landscape where technical excellence directly translates to market success.

The future belongs to broadcasters who can seamlessly blend human creativity and judgment with AI’s analytical power and scale, creating viewing experiences that satisfy both fans’ expectations and business imperatives.

References

- Reuters. “Amazon Thursday Night Football 2024 Viewership Data”

- Nielsen. “The Gauge Platform Share Analysis”

- Tom’s Guide. “NFL Streaming Costs Analysis 2025-26”

- NBC Sports. “Peacock NFL Playoff Streaming Records”

- Associated Press. “Internet Traffic Analysis During Live Sports”

- Comcast Corporation. “Peacock Streaming Infrastructure Reports”

- NFL.com. “Netflix Christmas Games Announcement”

- Netflix. “WWE Raw Acquisition Details”

- EMARKETER. “CTV Advertising and Measurement Trends”

- Marketing Dive. “Cross-Publisher Identity Resolution Challenges”

- Streaming Media Magazine. “Frequency Management in CTV”

- DoubleVerify. “CTV Fraud Detection Reports”

- Mux. “Low-Latency Streaming Technical Analysis”

- Disney Advertising. “Server-Side Ad Insertion Guidelines”

- Amazon Web Services. “Clean Rooms Technology Overview”

- Amazon Ads. “Frequency Management Solutions”