Qencode – AV1 Economics at Scale: Turning Compression into Revenue

AV1 has been the codec everyone talked about and few actually deployed across their catalog. The compression gains were real, but the economics and device support were too prohibitive for the majority of platforms.

Qencode’s latest AV1 update changes that. By bringing AV1 encoding down to $0.015 per output minute for SD and pairing it with usage-based delivery and storage, AV1 stops being a lab project and becomes a practical revenue lever for media and streaming businesses.

1. The economics finally make sense

Historically, AV1 encoding was too expensive to justify large-scale backfills. At older price points around $0.30/min, a 60-minute title could cost about $18 to encode. Multiply that across thousands of assets and the line item was hard to defend.

At $0.015/min, that same 60-minute title costs $0.90. Now encoding cost is small and predictable enough that it doesn’t block experimentation or catalog work.

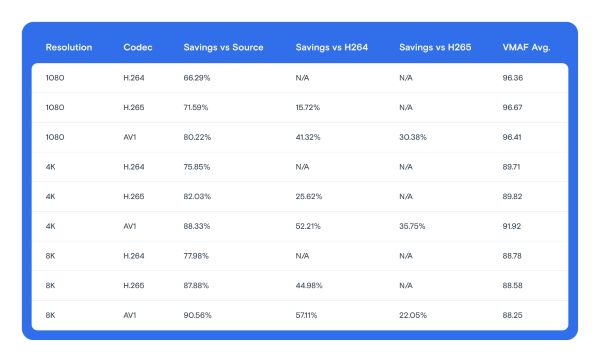

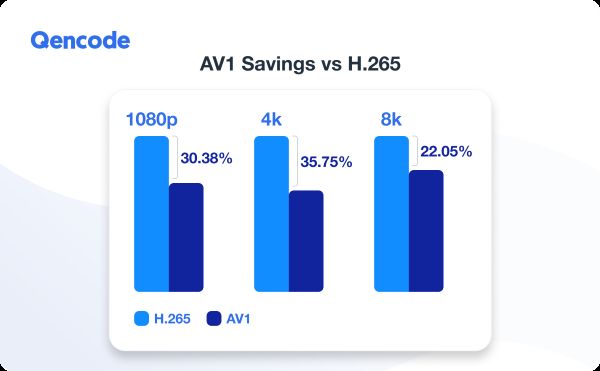

On the efficiency side, Qencode’s internal tests held visual quality constant and compared bitrate:

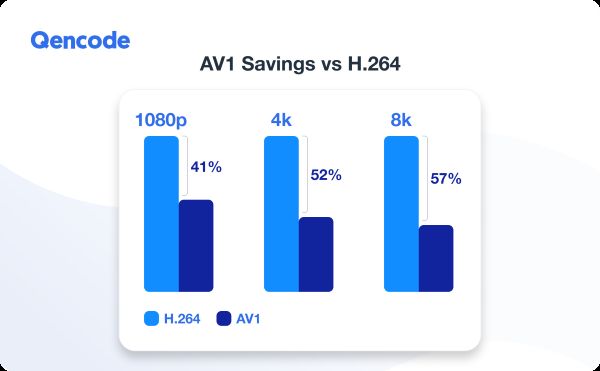

● AV1 vs H.264: roughly –41% at 1080p, –52% at 4K, –57% at 8K.

● AV1 vs H.265: roughly –30% average across the same set.

Exact numbers will vary, but the pattern is clear: similar quality at much lower bitrate. When encoding is cheap and the savings are large, AV1 becomes an obvious candidate for investment.

2. Where the money actually shows up

Most streaming P&Ls are dominated by delivery cost, not encoding.

If you look at cost per hour viewed, it’s mainly driven by bitrate and CDN price. With a typical 1080p H.264 rung around 4.5 Mbps, you land at a few cents per hour in delivery cost. Apply

AV1’s 40–60% bitrate reduction and that drops to roughly half, without changing perceived quality.

At higher resolutions, the effect is even stronger:

● For 4K, where baselines are tens of megabits per second, halving bitrate frees meaningful budget per hour.

● For 8K, each hour is so expensive that even moderate savings translate into large absolute dollars.

For AVOD and FAST, those savings either lift margins or fund more inventory. For SVOD and DTC, they can underwrite new UHD tiers, better promo offers, or entry into bandwidth-constrained markets without blowing up unit economics.

Encoding cost becomes the small, deterministic piece (minutes × price). Delivery is the big lever AV1 lets you pull.

3. Device readiness is no longer the blocker

The other historical objection was device support: “We can’t afford playback failures.”

That picture has changed:

● Modern Android versions ship AV1 decode; newer releases require encoder/decoder support from device makers.

● Chrome, Edge and Firefox support AV1 across desktop and Android.

● Safari 17 supports AV1 on hardware-capable devices.

● Newer M-series Macs and recent iPhones include AV1 decode in their media engines.

The safe pattern is straightforward: use multi-codec manifests (AV1 + HEVC + AVC) and let devices choose what they can play. Capable clients pick AV1, older ones stay on the existing codecs. This is the same tactic used in previous codec transitions.

4. From cost cut to revenue engine

It’s easy to frame AV1 as a pure cost-cutting move. The more interesting story is how it supports new revenue and better business models.

Ad-supported (AVOD/FAST)

In ad-supported models, stalls and long start times kill impressions. Lower bitrates at the same quality make it easier to stay below last-mile limits, especially on mobile and congested networks.

That leads to:

● More sessions that actually start.

● Fewer mid-roll interruptions.

● Longer, smoother viewing sessions.

All of that supports more completed ad views, higher fill, and better effective CPMs—without changing your sales motion.

Subscription and DTC

Subscription services can choose to:

● Bank the savings as higher margin per hour, or

● Spend the savings on 4K, higher frame rates, or HDR for premium tiers without raising their cost per stream.

Because encoding is now cheap and linear with duration, you can justify applying AV1 to only the top slice of your catalog by watch time, get the benefit where it matters most, and expand from there.

Adjacent sectors

The same logic applies outside “TV”:

● Gaming and e-sports: Highlight reels and live events can be delivered in higher quality for the same spend, or to more concurrent viewers.

● Fitness and education: Lower bandwidth per class or lecture improves unit economics for businesses with modest ARPU.

● Creator and UGC platforms: Per-video encoding becomes cheap and predictable enough to offer HD or UHD more widely without a CDN shock.

5. A few simple scenarios

To make this concrete, imagine three stylized cases.

Large HD catalog

● 10 million hours of 1080p per month.

● H.264 at about 4.5 Mbps; AV1 saves ~41% at equal quality.

Delivery cost per hour falls by around the same percentage. Multiplied by 10 million hours, the monthly savings quickly dwarf the one-time cost of re-encoding the top portion of your catalog at $0.015/min. The payback period is short.

4K premium tier

● 1 million hours of 4K per month.

● H.264 baselines in the 35–45 Mbps range; AV1 saves ~52%.

Here, each hour is relatively expensive to deliver. Halving bitrate can free enough budget to:

● Launch or upgrade a UHD tier while keeping margins healthy, or

● Improve profitability of an existing UHD offering without raising retail pricing.

Mobile-heavy regions

In markets where last-mile bandwidth is spotty, some share of sessions currently fail or stall enough that users abandon. Lowering bitrate for the same quality nudges more of those sessions into the “good enough” bucket, improving start rates and session length and, in turn, their monetization.

6. A practical rollout plan

From a developer and product perspective, a low-risk AV1 rollout looks like this:

1. Add, don’t replace. Configure AV1 outputs alongside H.264/H.265 in your encoding pipeline.

2. Start where it matters. Focus first on 1080p and 4K rungs that carry most of your watch time.

3. Use multi-codec manifests. For HLS/DASH, list AV1, HEVC and AVC renditions so players can choose.

4. Ramp by cohort. Begin with newer Android devices, modern browsers, and recent Apple hardware. Expand as you gain confidence.

5. Measure and iterate. Track GB delivered per hour, startup time, rebuffer ratio, ad completion and error rates before and after.

Once you see the impact on both cost and engagement, you can decide how aggressive to be with catalog backfills and ladder redesign.

7. Guardrails and what to track

A few honest caveats:

● Support is broad, not universal. There will always be legacy devices; multi-codec is the safety net.

● Gains are content-dependent. Sports, animation, and talking heads behave differently. Validate on your own mix.

● Live has its own trade-offs. For tight latency, you may need faster presets and slightly less compression.

To keep this tied to business outcomes, track:

● Cost per hour viewed, split by codec and resolution.

● Gross margin per hour viewed, combining monetization and delivery cost.

● QoE: startup delay, first frame, rebuffer ratio, error rate.

● Engagement and monetization: session length, ad view-through, conversions, churn.

8. Why this is democratizing

When advanced codecs are expensive, they become a moat for the largest players. Smaller platforms end up stuck on older ladders and higher costs.

Driving AV1 encoding down to $0.015/min for SD, with clear usage-based delivery and storage pricing, opens up the same compression advantages to mid-market platforms, new DTC entrants, niche FAST channels, and creator-focused products.

They can:

● Run per-title experiments without blowing the budget.

● Backfill only their highest impact titles.

● Make codec choice a normal product decision, not a board-level discussion.

In that sense, this update isn’t just about better bitrate. It’s about letting more companies use compression as a tool for margin, differentiation and new experiences, no longer reserved for the platforms with the biggest balance sheets.