Witbe – Winning the Fight for the CTV Home Page: Why Prime App Placement Drives Real Streaming Revenue

Noemie Galabru, CMO at Witbe

Connected TV (CTV) platforms have become the most strategic discovery surface in today’s media ecosystem. Whether on Roku, Fire TV, Samsung Tizen, LG webOS, or Google TV, the home page is now the first and often the only place where viewers decide what to watch. As fragmentation grows and advertising supported streaming accelerates, visibility on these home screens has become a powerful revenue lever for content owners, FAST channels, and streaming platforms.

Yet despite the importance of prime placement, very few companies can actually verify what their users see at home. Sponsored tiles, hero banners and featured carousels are negotiated with platforms, but teams rarely know whether these placements appeared consistently, behaved correctly, or guided viewers toward the intended content. In an environment where attention is scarce and switching is easy, this lack of real-world validation has significant economic impact.

A crowded Home Page and an Overwhelmed Viewer

The average Smart TV home screen now greets users with a maze of tiles, ads, trending rows, app promotions, and recommendations. This complexity is not just a UX challenge. It directly impacts subscriber retention.

Recent consumer research highlights how discovery fatigue now shapes streaming behavior:

- 32% of streaming users feel fragmentation negatively affects their TV experience.

- Viewers in the United States spend 14 minutes searching for something to watch. In France, this average rises to 26 minutes.

- 66% want a unified guide that aggregates content across all services.

- 19% abandon viewing entirely if they cannot quickly find content.

- Nearly half of all users say they would cancel a service because they cannot easily find what they want to watch.

These findings from Gracenote’s 2025 State of Play report confirm a simple reality. Most viewers discover content through whatever appears first. When the home screen is confusing or overloaded, frustration leads to abandoned sessions and eventually to churn. According to the report, the feeling of being overwhelmed affects around 40% of viewers aged 25 to 54, the demographic most valuable to advertisers.

Why Home Page Real Estate Drives Revenue

For streaming services, the home page functions like premium retail space. Platforms decide which apps appear in the top row, which shows receive hero placement, and which promotions dominate the first screens. These choices influence:

- which app is opened first

- which show viewers discover

- what content earns initial watch time

- which ads are served

- which subscription is chosen or reactivated

In many cases, platforms promote apps or programs even when those apps are not installed. This is increasingly visible on Google TV, Fire TV, and Smart TV’s interfaces. For example, a viewer searching for “Severance” on an Android TV will often be prompted to install Apple TV. This cross-service promotion means the platform home page can redirect viewing before the user ever enters a streaming app’s interface.

As AVOD and FAST services grow, home page placement has become even more valuable. TiVo’s Q2 2025 Video Trends Report shows that Smart TVs are now the dominant device for long form video, that 75% of households use their TVs daily, and that 55% of Smart TV owners consider the platform itself an important purchase factor. These findings reinforce how much influence the home page has on the beginning of every viewing session.

Smart TVs and Streaming Sticks: a Dual Discovery Economy

TiVo’s data reveals a clear split in how viewers approach content discovery.

Smart TVs

Smart TVs account for more than half of global big screen streaming, and their OS driven home pages shape mainstream household consumption. Promotions on Samsung, LG, and Vizio frequently outperform in app recommendations because they intercept users before browsing fatigue sets in.

Streaming Sticks

Devices like Roku, Fire TV Stick, and Chromecast still dominate younger, high engagement households. Their layouts surface more personalized rows, making prime placement especially influential for younger consumers.

Regardless of device type, one truth holds. The home screen determines what viewers watch first and what they might never see.

The Measurement Gap and the Need to Verify Real Behavior

Despite the financial stakes involved in home page placement, many companies still have limited visibility into whether their promotional efforts actually work for real viewers. Beyond questions of exposure, there is also the fundamental question of whether the user journey behaves as intended.

Teams regularly struggle to validate essential points such as:

- Did the sponsored placement actually appear on the devices and profiles that matter

- When the user clicks on the promoted tile, are they taken to the correct app or title

- If the promoted content requires an app installation, does the system correctly surface the install prompt

- Do device level differences or OS variations affect how the promotion behaves

- Does the featured content remain visible after a device restart, profile change, or UI refresh

- Are there UI conflicts where competing system recommendations override the sponsored item

With home page layouts in constant evolution, it becomes difficult to ensure that the full promotional path works end to end. A placement may appear, but the click through path might fail, return the wrong content, or behave inconsistently across platforms. These gaps affect both marketing performance and the viewer experience.

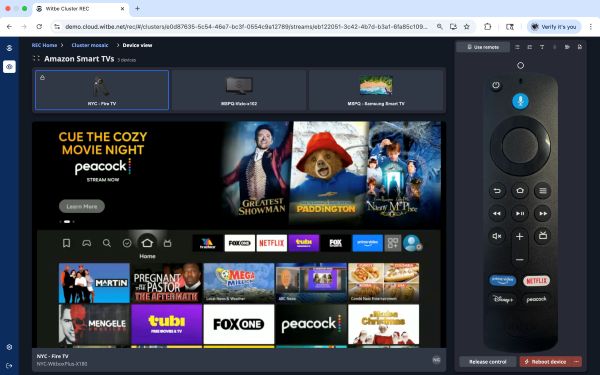

This is why the ability to verify real behavior on real devices is becoming essential. Observing the entire flow directly on physical CTV devices ensures that:

- the promotion appears where it should

- the tile is visible and accessible

- the click leads to the correct app or correct content page

- the installation suggestion appears when needed

- the overall experience reflects what users truly encounter at home

Few technology providers now offer real device testing and monitoring systems capable of validating these critical viewer journeys. Instead of relying solely on platform reported data, these tools confirm that the promotional path behaves correctly from the moment the TV is turned on to the moment the content begins to play. For streaming platforms, studios, and FAST operators, this technical verification is becoming just as important as measuring exposure.

Real device testing and monitoring technology capable of remotely and automatically validating critical viewer journeys from the discovery home screen.

Conclusion: In a Fragmented World, Visibility is Everything

As streaming becomes more complex and competitive, the CTV home page has evolved into one of the most influential and expensive touchpoints in the viewer journey. With half of consumers willing to cancel a service because they cannot find what they want, discovery has become a direct driver of satisfaction and revenue, ensuring promotions behave correctly and guide viewers to the intended content is a strategic necessity.

Real device visibility into home page behavior provides confidence that promotional investments deliver the expected value. It ensures that viewers see what they are supposed to see, and that the journey from tile to playback works seamlessly.

In the fight for the home page, the advantage goes to those who can validate the experience end to end.

Data references:

Gracenote. “2025 State of Play.” Nielsen / Gracenote, November 2025. Global survey of 3,000 streaming viewers across six markets, analyzing search duration, fragmentation impact, and churn drivers.

https://gracenote.com/insights/2025-state-of-play/

TiVo (Xperi). “Q2 2025 State of Play Highlights.” TiVo for Business, 2025. U.S. consumer insights on Smart TV usage, home screen behavior, and device-level viewing patterns.

https://blog.tivo.com/tivo-for-business/highlights-from-tivos-q2-2025-report/

TiVo (Xperi). “Smart TV Nation: Key Streaming Trends.” Survey presentation, 2024–2025. U.S. data on Smart TV adoption, daily viewing habits, and home screen promotional visibility.

TiVo_Advertising__smart_tv_slides_final.pdf

Friedman, Wayne. “Streaming Discontent: Content Discovery, Fragmentation.” MediaPost, November 5, 2025. Analysis of Gracenote’s State of Play findings and industry fragmentation trends. https://www.mediapost.com/publications/article/410426/streaming-discontent-content-discovery-fragmenta.html